UK Outlook: Beyond the Brexit stalemate

28th January, 2019

As we enter 2019, the outlook for the UK economy remains dependent on the near- term path of Brexit. Determining where that path may lead has been elusive. It seems like the real debate only began in mid-December.

If the UK signs a deal, any deal that clarifies the future direction of travel for the economy, we expect business and consumers to adjust to the new normal. As a result, we would expect a minor boost to growth as business investment recovers, wages improve and the budgeted slight fiscal stimulus support consumption. GDP growth will be relatively low at 1.5%, but that should be sufficient to keep the unemployment level low. We would expect UK equities to perform well, as globally oriented FTSE 100 companies and small and mid-cap domestically oriented companies benefit from decreased uncertainty.

A scenario of a no-deal Brexit or an election where Labour wins would result in weaker sterling, meaningful inflation and domestic industry struggling with higher input costs and a limited ability to pass higher prices on to consumers.

If a second referendum goes ahead and a decision is made to remain, we would expect a more significant appreciation of sterling and UK equities. Our base case continues to be that some sort of deal will be agreed, a transition period will start in March and negotiations on a long-term trade deal between the UK and European Union (EU) will begin in earnest.

A less benevolent environment

The UK has recovered since the financial crisis, but growth remains sluggish and has depended on increased employment rather than increased productivity. According to the Office for Budget Responsibility (OBR), the referendum vote to leave the EU weakened the economy. The fall in sterling squeezed real household incomes and consumption, while providing only a modest boost to net trade. Meanwhile, uncertainty on the Brexit negotiations dampened business investment. The OBR studies suggest that the economy was 2-2.5% smaller by mid-2018 than it would have been if the referendum had not been called. The UK has dropped from close to the top of the G7 growth league table to near the bottom, even though it has benefited from a supportive global economy during the past three years.

Now the global economy is slowing, which will be a less favourable environment for the UK for the next few years. We also expect increased cost pressures from the current tight labour market. With inflation above target, increasing wage growth and domestic costs, significant fiscal stimulus and an increasingly positive output gap, we think that the Monetary Policy Committee (MPC) will pick up the pace of tightening once the UK is firmly on the path to a soft Brexit. The Bank of England’s current forecast would entail one interest rate hike per year in the next two years as long as there is no major Brexit shock for the economy.

Consumers continue to be at risk

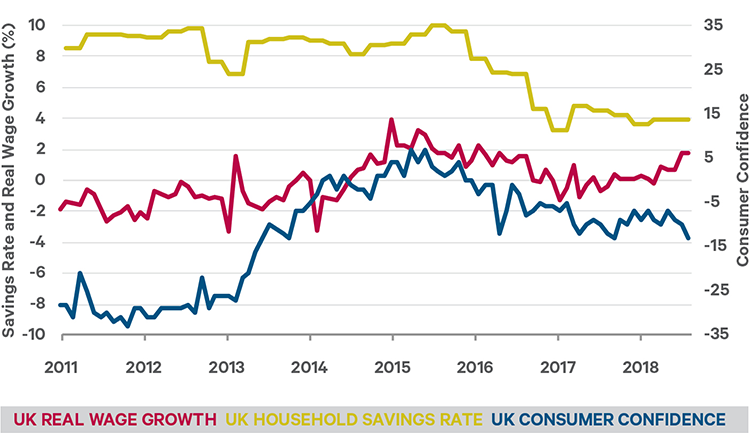

Consumer spending has been one of the driving forces of the UK recovery. But concerns remain about the basis of this spending – are consumers using up their savings and taking out loans? The OBR estimates that the household savings ratio net of pension contributions has recently turned negative, while consumer debt continues to rise as a percentage of income, signaling a delicate situation for consumers. In the aftermath of the vote to leave the EU, consumer confidence dropped sharply but quickly recovered to pre-vote levels. It has recently been drifting down again as progress in the Brexit talks has stalled.

Figure 1: Savings, wages & consumer confidence

Source: Bloomberg. 30th November 2018.

Manufacturing limited

A strong performance by the manufacturing sector during 2017 weakened in 2018. In addition, the competitive boost from the fall in sterling faded and global trade tensions increased. Business investment has continued to fall because of Brexit uncertainties. Manufacturing has a symbolic place in British economics, even though its importance has declined consistently over the decades. In 1948, manufacturing accounted for approximately 36% of GDP, compared with about approximately 10% currently. Today, the services sector is the real powerhouse of the UK economy, accounting for almost 80% of GDP. It is one of the few parts of the economy to have surpassed its pre-recession peak. The real challenge for the UK is how to protect the largest part of its economy after leaving the EU as the Single Market provided frictionless trade in goods and services. Traditional trade agreements, of the kind the Brexiteers see as their future, cover only manufactured goods, leaving the clear majority of the British economy to cope outside of a formal agreement.

The UK economy will be highly influenced by the outcome of Brexit. Business and consumer confidence will be critical factors in the direction of travel for the economy and markets, and even a little more clarity will go a long way in providing a more rosy outlook.

WARNING: Past performance is not a reliable guide to future performance. The value of investments and of any income derived from them may go down as well as up. You may not get back all of your original investment. Returns on investments may increase or decrease as a result of currency fluctuations. Returns on investments may increase or decrease as a result of currency fluctuations.

WARNING: Forecasts are not a reliable indicator of future performance.