Evolution of portfolio returns

30th November, 2020

The first half of 2020 has altered the economic and investment landscape more than any other period in modern history. Unprecedented monetary and fiscal policy response to the pandemic and the economic impact of policies to reduce the spread of the virus will have an effect on the global economy for years to come.

Building the right portfolio

At Davy, our goal is to help individual investors, foundations, charities and institutions achieve their financial objectives. While short-term volatility may be an important risk for some investors, a client with a 10/15-year time horizon can likely withstand short-term variability of their capital, viewing the greatest risk to be that of not achieving a sufficiently large portfolio in retirement to fund their needs.

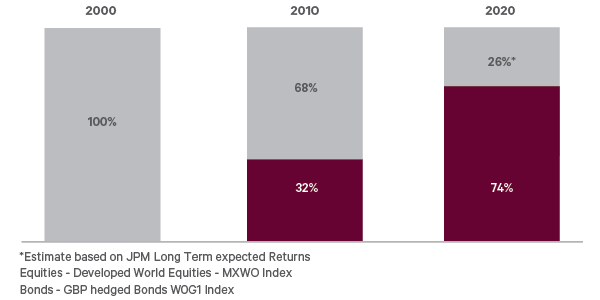

Today the balancing act between these risks is more important than ever. With expected long-term returns on most assets at historically low levels, portfolio returns are in all likelihood going to look significantly different to what they did for the past 20 years.

Figure 1: Comparison of what investors needed over the past 20 years vs what they need now to achieve a 5.3% return.

Source: JP Morgan; Davy; Assumes equity dividends reinvested. Cash forecast according to JP Morgan Long Term Capital Market Assumptions (LTCMA) 2020; Graphs are illustrative purposes

Long-term portfolio allocations

Recent upheavals in capital markets and central bank intervention due to Covid-19 provide an opportunity for us to highlight exactly what strategic asset allocation (SAA) is and, just as importantly, what it is not. Fundamentally, the SAA is designed to achieve long-term goals rather than reflect short-term market shifts. It is the most significant determinant of long-term returns for investors and it is the anchor in the portfolio from which any short-term adjustments are made.

Most investment commentary tends to focus on short to medium-term issues such as near-term economic growth, unemployment figures or the earnings prospects for companies. However, the returns that investors achieve over the longer term are determined by factors which play out over a much longer horizon. It doesn’t mean regular commentary is without purpose, but it should not influence long-term asset allocation decisions or financial planning advice.

Review outcomes

Through significant action by central banks around the world, today most assets are relatively richly priced. However, these asset classes still have different expected returns. Similar to the past, expected returns on equities are higher than what we would expect for bonds and cash. In fact, the expected returns on bonds and cash for the next 10 years are so low that there is very strong chance they won’t even beat inflation. A very important point here is that while bonds may provide some level of protection in the future, it is expected to be notably less than it has been in the past, given the limited room for yields to fall from their current historically low levels (NB. falling bond yields equals rising bond prices).

With very little, or potentially negative, return expectations bonds may warrant a smaller allocation in client portfolios. This reduction is best recycled into growth assets like equities, where we have a higher return expectation.

Let’s look at a simple example of why this is. Although equity dividends have historically grown at above the rate of inflation, let’s assume dividends remain the same. Global equities would need to decline 15.9% between now and 2030 for equities to match cash returns at current yields. Equities would need to decline by 14.5% to match the return on a 10- year UK Gilt. While not impossible, we believe these scenarios to be highly improbable. Therefore, in our assessment of long-term SAA, our first outcome is that we believe it may be more appropriate to reduce the allocation to fixed income that portfolios have traditionally held.

A second outcome of this review of our long-term allocations (SAA) is that we will be moving towards a more global portfolio and reducing the allocations we currently have to domestic equities and bonds. This positions us in line with global markets and makes us less reliant on domestic markets to deliver portfolio returns.

Thirdly, given this environment of lower expected returns we are aware that the fees incurred in our portfolios are increasingly important. To that end, we have been negotiating fees with many third-party fund providers and are now in a position to obtain lower costs on many of our investments.

Implications

Each of these outcomes are currently being assessed in how it may affect each of our clients and their optimal portfolio allocations. While long-term asset allocations (SAA) aren’t expected to move significantly for clients, we expect that some discretionary client portfolios will be amended to reflect these views.

Ultimately, the overriding objective is that our clients achieve the best risk-adjusted return outcome suitable to their individual circumstances. We may have to accept greater short-term volatility to achieve these goals, but we believe the long-term risk of failing to keep pace with inflation is the greater evil.

Please get in touch with your Wealth Manager to discuss the specifics of your portfolio, and what changes, if any, may be applied.

Warning: The information in this article does not purport to be financial advice as it does not take into account the investment objectives, knowledge and experience or financial situation of any particular person. You should seek advice in the context of your own personal circumstances prior to making any financial or investment decision from your adviser.

Warning: Past performance is not a reliable guide to future returns and future returns are not guaranteed. The value of investments and of any income derived from them may go down as well as up. You may not get back all of your original investment. Returns on investments may increase or decrease as a result of currency fluctuations.

Warning: Forecasts are not a reliable indicator of future performance.